We Make Insurance Easy!

Serving Chagrin Falls &

Northeast Ohio since 1971.

Click Now to Start Your Experience

Lyndall Insurance is customer friendly and willing to help at the drop of a hat. We had a large storm damage some of our property and as soon as they heard the owners were out to take a look at things and see if we were ok. They are a class act and we are lucky to call them our insurance agents. We highly recommend them to insure you!

-Tiffany M.

Great agency that really cares about their clients. We had a unique and stressful auto claim situation that I don't know we could have handled ourselves at all. Everyone at Lyndall was super helpful. They walked us through every step, connected all the dots we couldn't figure out for ourselves, and basically just did everything possible to make sure we came away taken care of and satisfied. Highly recommended.

-Brian S.

We have been clients of Bill Davis for over 30 years. Our interests have always been the first priority. Bill always makes sure we have the best coverage at the best price for car and home insurance. Can’t ask for anything more!

-Karen C.

Dave Ries and the team at Lyndall have been great to work with as I evaluated my options and gained their insight. Very helpful!

-Phillip R.

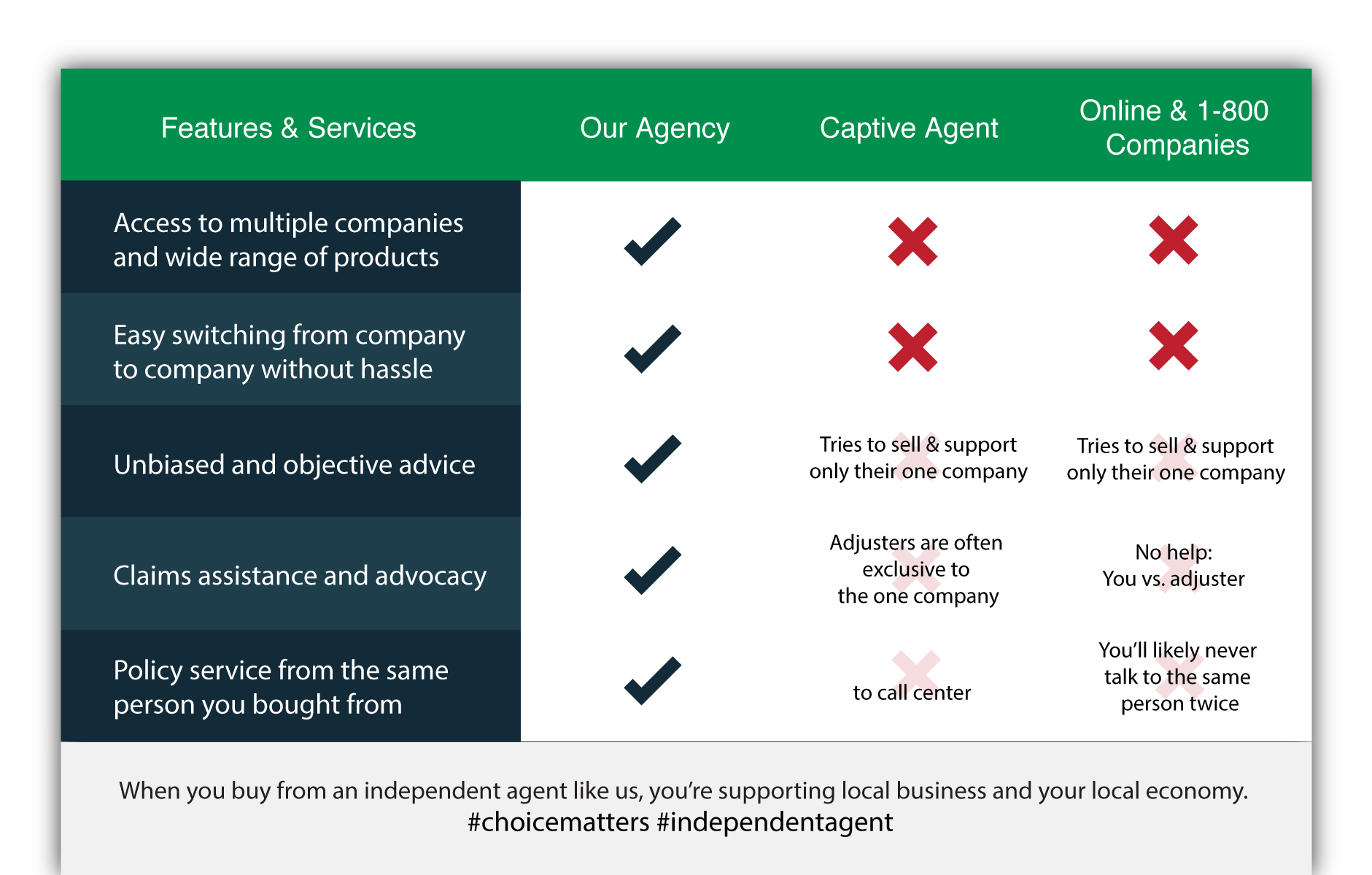

We offer the widest range of products and pricing in Northeast Ohio.

Here’s why we’re different than the rest: